Sales Taxes: Difference between revisions

From LibertyWin.org

(Created page with "355x355px|thumb|NH is one of the few states that has no sales tax. New Hampshire has no general sales tax. When you go to a supermarket, and you see the price of a good, that is the price you will pay for that good.") |

|||

| (3 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

[[category:taxes]] | |||

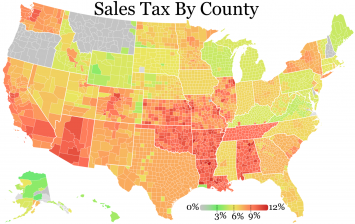

[[Image:Sales tax.png|355x355px|thumb|NH is one of the few states that has no sales tax.]] | [[Image:Sales tax.png|355x355px|thumb|NH is one of the few states that has no sales tax.]] | ||

New Hampshire has no general sales tax. When you go to a supermarket, and you see the price of a good, that is the price you will pay for that good. | New Hampshire has no general sales tax. When you go to a supermarket, and you see the price of a good, that is the price you will pay for that good. | ||

===Meals and Rooms Tax=== | |||

New Hampshire has a Meals and Rooms Tax of 8.5% that acts as a sales tax on prepared meals and when renting a hotel room. This tax is also being targeted by pro-liberty legislators. | |||

Latest revision as of 07:14, 18 February 2023

New Hampshire has no general sales tax. When you go to a supermarket, and you see the price of a good, that is the price you will pay for that good.

Meals and Rooms Tax

New Hampshire has a Meals and Rooms Tax of 8.5% that acts as a sales tax on prepared meals and when renting a hotel room. This tax is also being targeted by pro-liberty legislators.